Working Capital Financing

Working Capital Financing gives you the ability to cover a multitude of business costs in the form a short-term, financed loan. Whether its for operational needs to help grow your business or it’s to bridge the gap of out-of-pocket expenses prior to payment for a project – either way, we’ve got you covered.

- Short-term, unsecured loan ranging from $10,000 – $250,000

- Repayment plans of daily, weekly and monthly are available

- Use only what you need; unused funds are available for 90 days

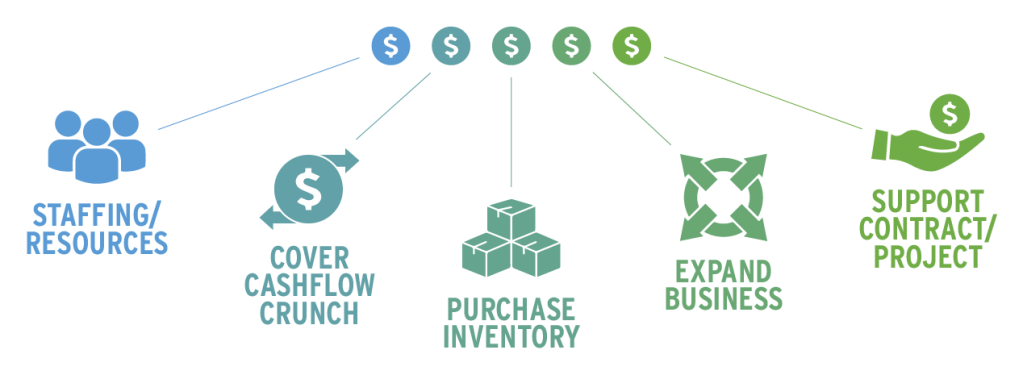

Use these funds for business needs such as:

- Equipment repairs

- Inventory needs

- Expansion projects

- Marketing plans

- Covering the ‘Seasonality’ of your revenue stream

- ‘Stop Gap’ financing to cover materials, inventory or labor costs for a project or contract

Process:

- Complete application

- Same day approvals

- Get the funding you need wired to your bank

- Start growing your business

So, who benefits from Working Capital Financing? EVERY BUSINESS.

North Star Leasing has been dedicated to providing easy access to flexible equipment financing solutions since 1979. Our commitment to personalized service sets us apart in the industry— no impersonal credit scoring systems, and a dedicated Equipment Financing Expert to help you navigate the process. When you call North Star Leasing, you’re treated as a valued customer, not just a number.

Questions? Contact:

John Henning

VP, Business Development

and Working Capital

JHenning@northstarleasing.com

802-860-2929